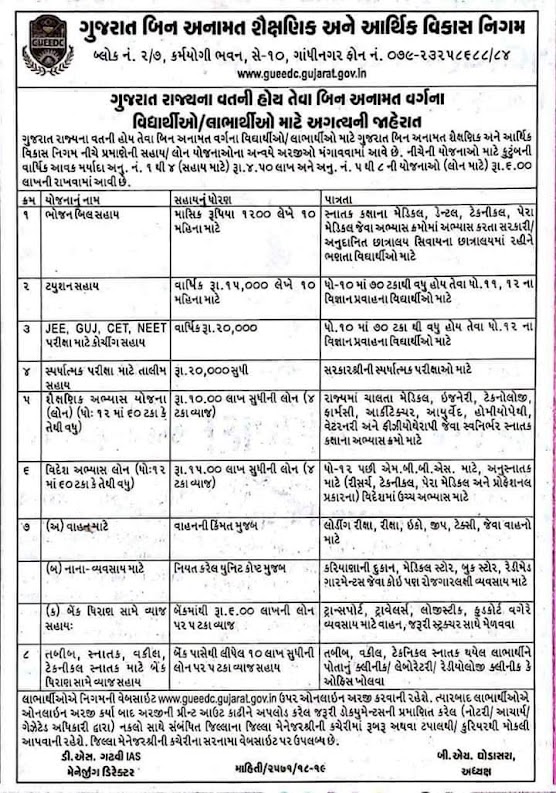

Gujarat Unreserved Educational & Economical Development corporation Various Scheme for in Online Apply 2019.

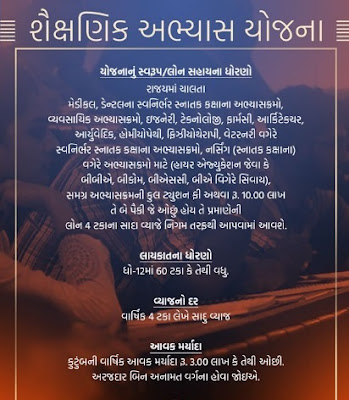

Name of the scheme: Academic study plan GUEEDC

Scheme form / loan assistance standards:

Medical courses in the state, Dental Self Financed Bachelor's courses for Professional Courses, Engineering, Technology, Pharmacy, Architecture, Ayurvedic, Homiopathy, Physiotherapy, Veterinary courses, Nursing (Bachelor's) courses etc. For Higher Courses such as BBA, , BAC, BA, etc.), the total tuition fee or Rs. 0.00 lakh and it will be given from 4 percent simple interest loan according to the corporation, which of the two is less.

Eligibility standards: 60% or more in standard 12

Rate of Interest: Sense of Annual 4% per Annum

>

Income Limit: Family annual income limit is Rs.6.00 lakh or less.

The applicant should have a non-reserved category.

Eligibility and credit criteria for educational plans

Must have passed from any school in Gujarat state with 60% or more in standard 12.

The loan will be eligible for the curriculum which is affiliated with the syllabus of that course.

The applicant should be from Gujarat and must be non-reserved.

Proof of admission in affiliated curriculum will be presented.

Interest rate of interest will be 4% per annum. Lending will be given per year. Accordingly, the simple interest will be counted.

The widow and orphan beneficiary will have to give preference to the applicant.

Loans for non-lecturers who have left the study period or who have not passed the degree, will be eligible for reimbursement together and interest subsidy will not be available.

The annual family income limit for the state's educational plans will be 6.00 lakhs.

Loan / Loan for Documents:

If the total amount of loan is Rs.7.50 lakh or less for the whole loan, they will not have to make any mortgage (mortgage), but only two sureties of bail will be submitted.

If the total amount of loan is more than Rs.7.50 lakh, then it will have to be mortgaged in favor of the real estate corporation of its own or any other relative.

Each lender has to pay five BLANK checks signed in favor of Corporation.

Loan repayment:

- In case of total loan upto Rs.5.00 lakhs, after one year of completion of the study, the loan amount will be paid in interest of one monthly installment in the 5 (five) years.

- In case of a loan of more than Rs.5.00 lakh, after one year of completion of the study, the loan amount will be filled in interest of one monthly installment in 6 (six) years with interest.

- The repayment loan will be credited to the first interest.

- The loan can be repaid even before the time taken by the lender.

Gujarat Unreserved Educational & Economical Development corporation Various Scheme for in Online Apply 2019.

Post a Comment